43 403b vs 401k

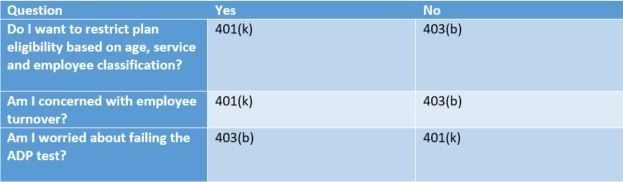

403(b) vs 401(k) Accounts: What's the Difference? The Type of Employer 2022 403(b) vs. 401(k) comparison chart 2022 403(b) vs. 401(k) comparison chart Feature 403(b) 401(k) Eligible employer Educational organizations and nonprofi t organizations under 501(c)(3) of the IRC Any employer Eligible employees All employees but may exclude: • Employees who work less than 20 hours per week • Professors on sabbaticals • Certain students

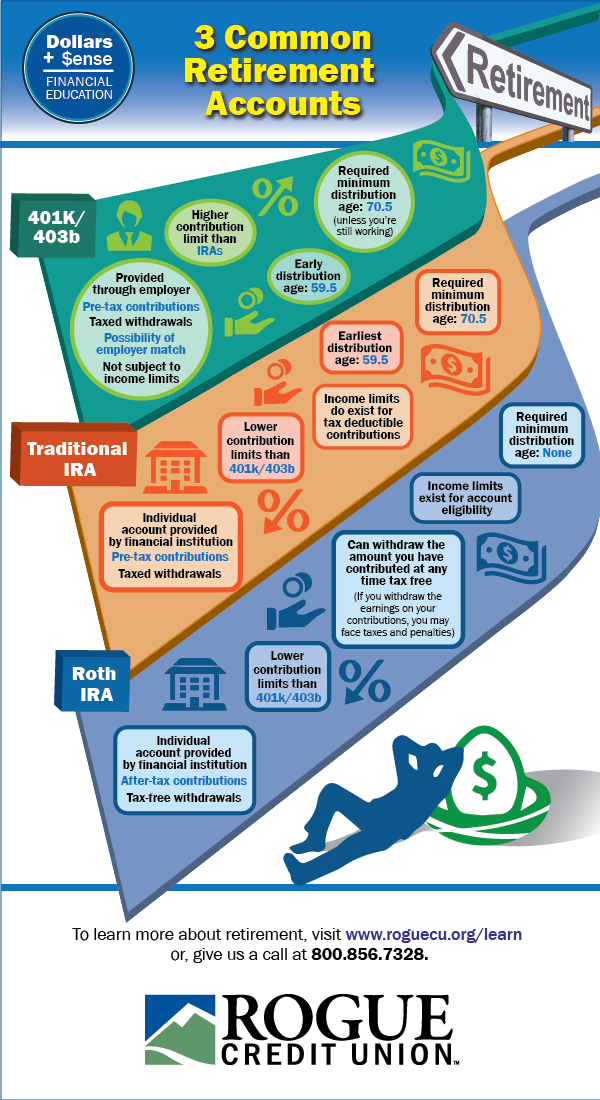

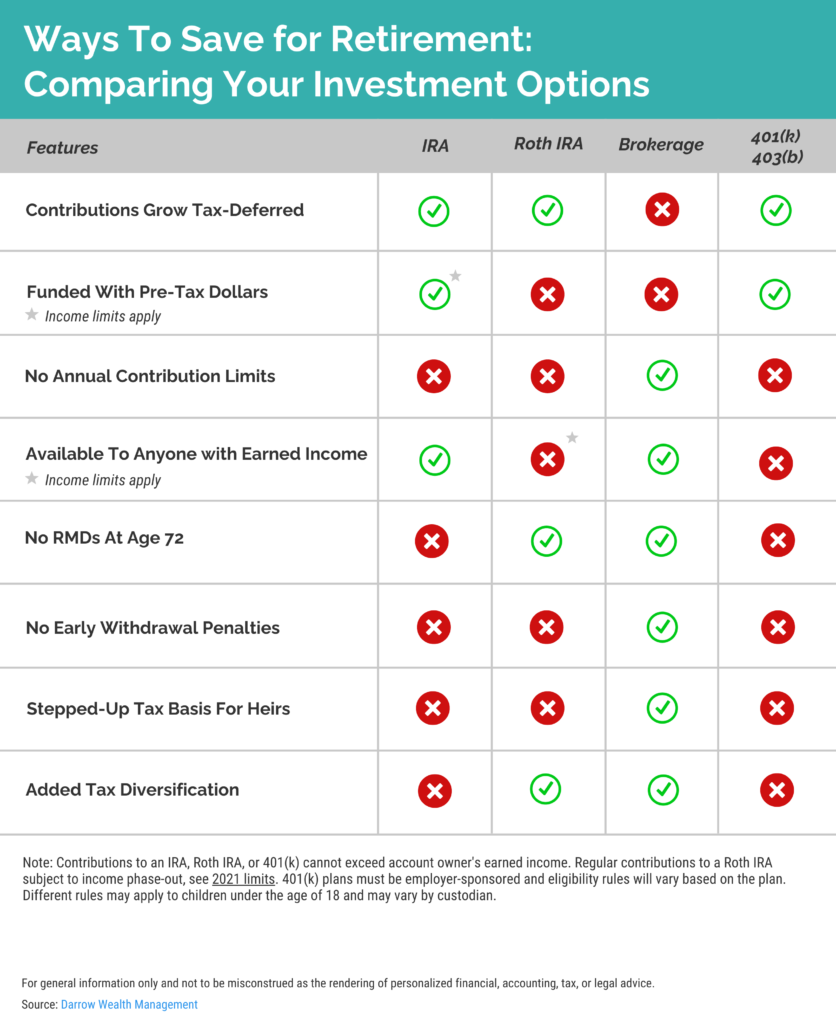

403b Vs. 401k: What’s The Difference? – Forbes Advisor Most for-profit companies offer 401(k)s, which help their employees build tax-advantaged retirement savings. Depending on whether you choose a traditional or Roth 401(k), plan contributions are withheld from your paycheck pre-tax or after-tax. With a traditional 401(k), your plan contributions are deducted from your pay before income taxes, which decreases your taxable income today. You pay taxes on withdrawals from your 401(k) account when you are in retirement. If you choose a Roth 401(k), you pay income taxes on your plan contributions today, and you owe no income tax on withdrawals in retirement. In either type of plan, your money grows tax free, and investment gains are not subject to capital gains taxes. If you need to withdraw funds before retirement age—currently 59 ½—you generally owe a 10% penalty, plus income taxes on any money that hasn’t been taxed yet. To help your money grow, 401(k)s let you invest primarily in mutual funds. You can choose a mix of stock and bond fund...

403b vs 401k

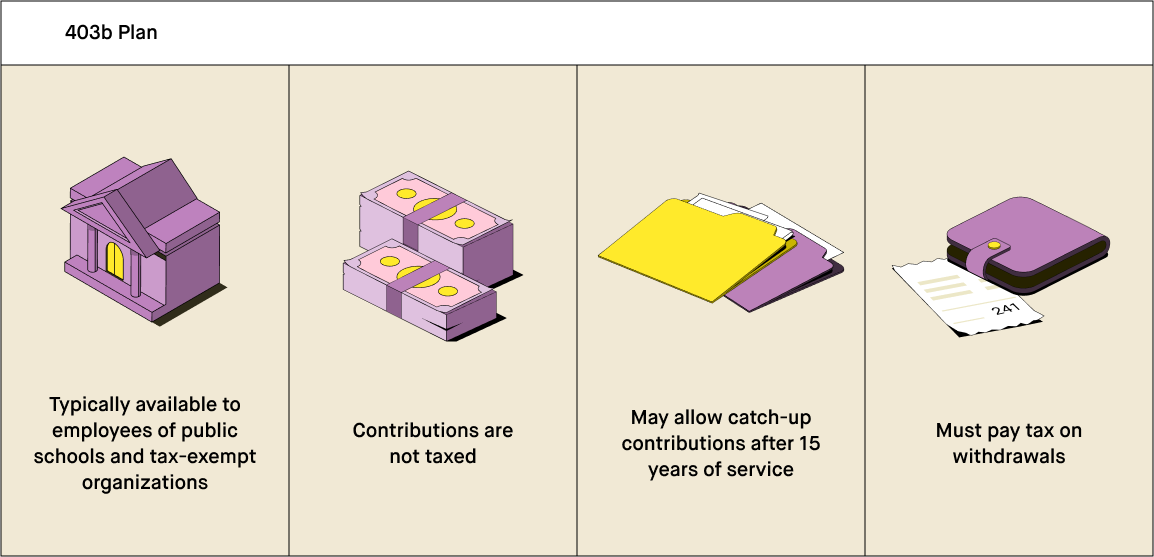

The Differences Between 401(k) and 403(b) Plans Mar 19, 2021 · A 403(b) plan is also another name for a tax-sheltered annuity plan, and the features of a 403(b) plan are comparable to those found in a 401(k) plan. Employees of tax-exempt organizations are ... What are the 403b Rollover Rules? | IRA vs 401k Central 22.6.2014 · Non-profit employers and public education organizations often offer their employees 403b retirement savings accounts, which allow them to make pre-tax contributions with every paycheck to fund their retirement. 403b accounts are very similar to 401k plans that are offered to employees of larger for-profit and private companies. If you have a 403b plan and you are … 403(b) vs. 401(k): What’s the Difference? | RamseySolutions.com Jan 20, 2022 · 403(b) and 401(k) plans have a lot in common. You can use either one to chase down your wildest retirement dreams! The main difference between a 403(b) and a 401(k) is the type of employer who offers them. 401(k) plans are offered by private, for-profit companies, but 403(b) plans are offered by nonprofit organizations.

403b vs 401k. 403(b) vs. 401(k): What’s the Difference? | RamseySolutions.com Jan 20, 2022 · 403(b) and 401(k) plans have a lot in common. You can use either one to chase down your wildest retirement dreams! The main difference between a 403(b) and a 401(k) is the type of employer who offers them. 401(k) plans are offered by private, for-profit companies, but 403(b) plans are offered by nonprofit organizations. What are the 403b Rollover Rules? | IRA vs 401k Central 22.6.2014 · Non-profit employers and public education organizations often offer their employees 403b retirement savings accounts, which allow them to make pre-tax contributions with every paycheck to fund their retirement. 403b accounts are very similar to 401k plans that are offered to employees of larger for-profit and private companies. If you have a 403b plan and you are … The Differences Between 401(k) and 403(b) Plans Mar 19, 2021 · A 403(b) plan is also another name for a tax-sheltered annuity plan, and the features of a 403(b) plan are comparable to those found in a 401(k) plan. Employees of tax-exempt organizations are ...

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/agreement-and--discussion-1189829021-109d3b8bd8854ad1b0b7b981355d0571.jpg)

0 Response to "43 403b vs 401k"

Post a Comment