43 defined contribution pension plan canada

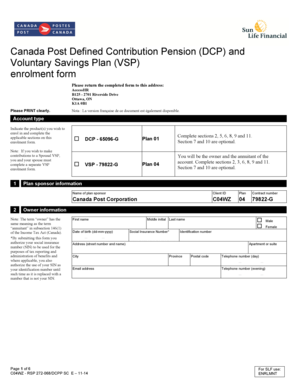

10.2.6 Employer pension plans - Canada.ca A defined contribution pension plan establishes a set amount that you and your company will contribute to your plan each year. The amount is based on how much you make. Defined contribution plans don't guarantee what you will get when you retire; that depends on how well the plan is managed. PDF Defined Contribution Pension Plan - Ontario Tech University UOIT Defined Contribution Pension Plan ... (Canada) and the Pension Benefits Act (Ontario) registration number 1087808. The Plan was established with an effective date of January 1, 2003 and a December 31st year end. It is funded under Group Annuity Policy 63472-G issued by the Sun Life Assurance

Defined Contribution Conference - Discover The Best Events ... Event: Pensions & Investments East Coast Defined Contribution Conference When: March 3-4, 2008 Where: PGA National Resort & Spa, Palm Beach, Florida What: Defined-contribution plan sponsors, providers and consultants come together to discuss compliance, best practices and the changing regulations in retirement benefits.

Defined contribution pension plan canada

Defined Contribution Pension Plan - RBC Royal Bank Royal Bank of Canada (RBC) is acting in its capacity as a delegate of your employer in connection with its Defined Contribution Pension Plan. MyAdvisor is a platform provided by RBC. Financial planning services and investment advice provided in connection with any RBC investment account opened outside the Defined Contribution Pension Plan is ... Defined Contribution Plan Defined Contribution Plan Defined Contribution Plan In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned. Defined contribution pension plan - Canada Life A pension plan is a way for you and your employer to set aside money for your retirement. A defined contribution plan is the most common type of pension. Both you and your employer contribute a percent of your salary over the time that you're working, and when you retire you can convert that money into your retirement income.

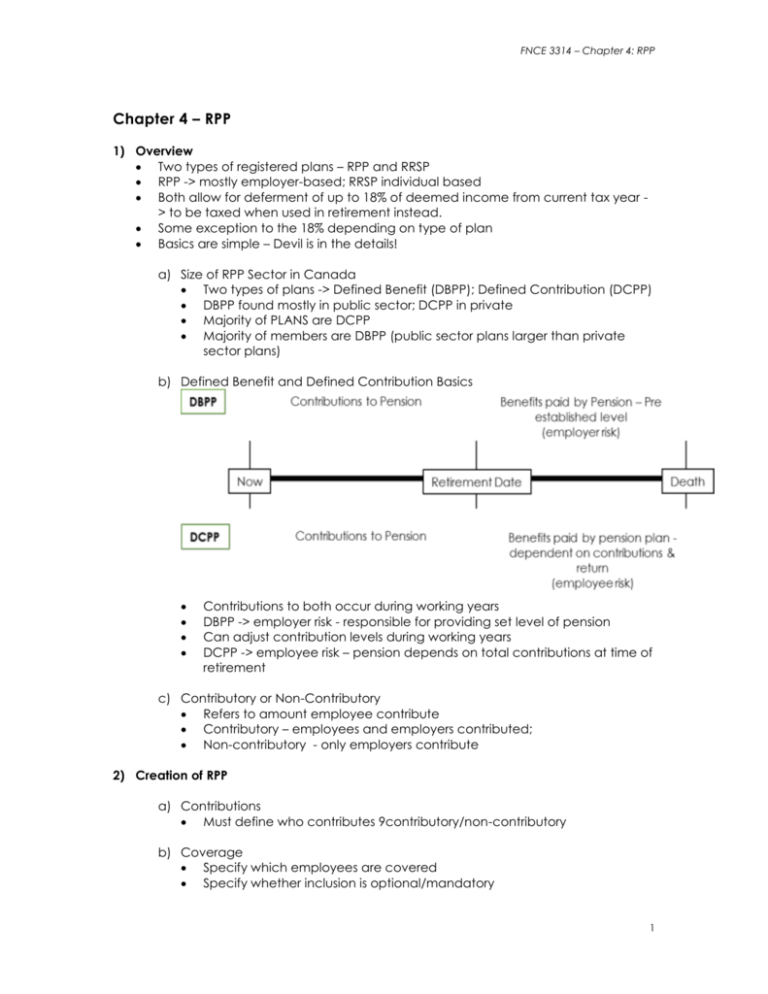

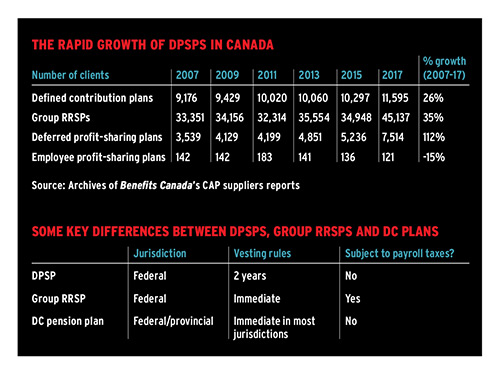

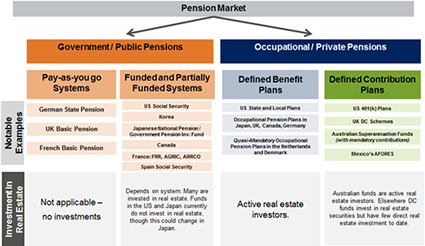

Defined contribution pension plan canada. Defined-Contribution Plan Vs. Defined-Benefit Pension Plan ... On the other hand, a Defined-Contribution Pension Plan grants employees the opportunity to contribute funds over time to save for their retirement and the employer provides matching contributions to a certain amount. Your employer may also have a Deferred Profit Sharing Plan (DPSP) for you upon retirement. PDF 4 Defined Contribution Pension Plan (RPP) Welcome to ... The Sherwin-Williams Canada Inc. Salaried Employees Retirement Plan III, a Defined Contribution Pension Plan (DCPP) and a Registered Pension Plan (RPP) can help you accumulate funds for your retirement. You make no contributions to this Plan. All contributions to your account are made by the Company if you meet the eligibility requirements. Defined Benefit vs Defined Contribution Pension Plans in ... There are two main types of registered pension plans in Canada - the Defined Benefit Pension Plan (DBPP) and Defined Contribution Pension Plan (DCPP). A brief definition of both plans is as follows: Defined Benefit Pension Plan In this pension plan, the employer promises to pay you a predetermined monthly income for life after retirement. Registered pension plan (RPP) - Canada Life Canada Life offers only defined contribution plans. Defined contribution plans Your retirement income will depend on how much you and your employer contribute and how well it performs in the market Usually a percentage of your current income You and your employer or sponsor may both contribute Learn more about defined contribution plans

Defined contribution pension plan canada Can you withdraw from a defined contribution pension plan Canada? Defined contribution plans require that you collapse the plan by the end of the year you turn 71. At that point, you can withdraw the funds and pay tax on the income, transfer the assets to a registered retirement income fund ( RRIF ) or purchase an annuity. What is a defined benefits pension plan? - Canada Life Canada Life only offers defined contribution plans, but you may have a defined benefit plan from another provider or an older plan. Defined benefit plans can be complicated, but here are the basics. Complex formula, consistent results With a defined benefit plan, your retirement income is decided by a formula. Defined Contribution Pension Plan in Canada: Complete Guide The Defined Contribution Pension Plan in Canada is one of the two popular pension plans used by Canadians. A Defined Benefit Pension Plan (DBPP) differs from a Defined Contribution Pension Plan in several ways: The company offering DBPP guarantees a fixed amount of income for their employees after their retirement. The DBPP is not a portable plan. Defined Benefit Pension Plan in Canada: Fully Explained The DBPP is one of the two main pension plans used in Canada. The Defined Contribution Pension Plan (DCPP) is another pension plan that has become popular over the years. It can differ in several ways from the DBPP including: A DCPP requires employees to make contributions to their plan, and the employer may match their payments.

Defined contribution pension plan - finiki, the Canadian ... Canada Pension Plan (CPP) Québec Pension Plan (QPP) CPP and QPP calculator v t e A defined contribution pension plan ( DCPP or DC plan ) is one type of a Registered Pension Plan. A DCPP has no pre-determined payout at retirement, it is based on the assets in the plan at the time your retire. Defined benefit vs. defined contribution: What is the best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth. Employer-sponsored pension plans - Canada.ca Defined contribution pension plans In a defined contribution pension plan, you know how much you will pay into the plan but not how much you will get when you retire. Usually you and your employer pay a defined amount into your pension plan each year. The money in your defined contribution pension is invested in one or more products on your behalf. TaxTips.ca - Defined Contribution Pension Plan Characteristics Characteristics of Defined Contribution Pension Plans (Money Purchase RPPs) Pensionable age is specified by the pension plan and can vary from plan to plan. Pension payments cannot be split between spouses, except in the case of a court ordered split, due to separation or divorce.

Contributions to a registered pension plan (RPP) - Canada.ca For information on contributions to an RPP for current or past service, see archived Interpretation bulletin IT-167, Registered Pension Plans - Employee's Contributions, and Guide T4040, RRSPs and Other Registered Plans for Retirement. You have to report these contributions on a T4 slip. For more information, see Box 20 - RPP contributions.

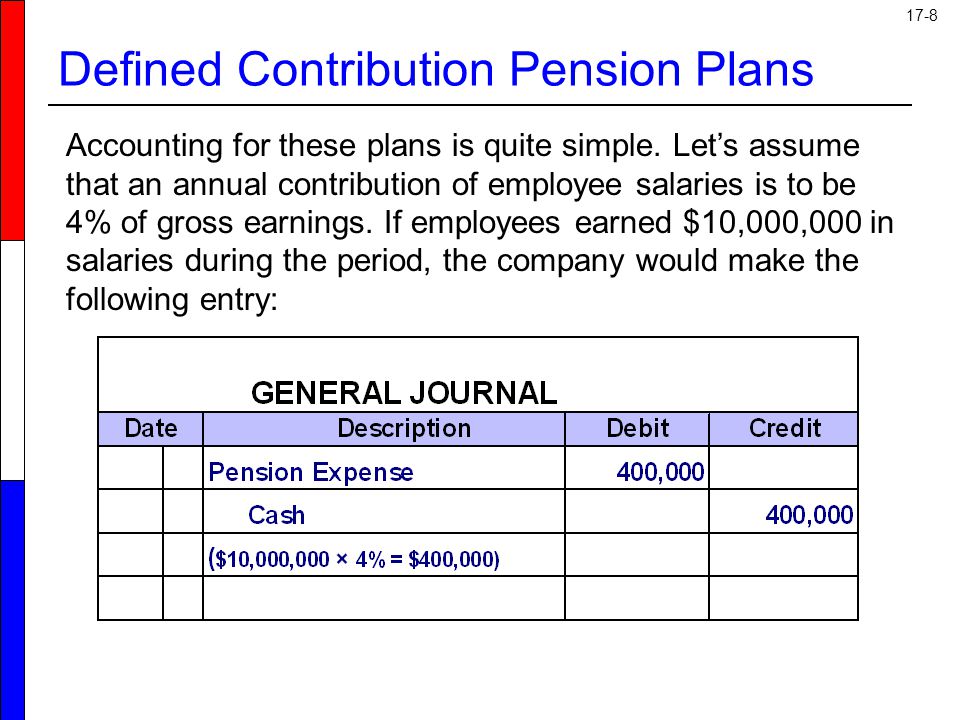

Defined Contribution Plans - GroupBenefits.ca Defined Contribution Plans Under a Defined Contribution Pension Plan (also called a "Money Purchase" Pension Plan), the contributions of plan members and plan sponsors are invested towards the funding of a retirement income. The maximum combined contribution is the lesser of 18% of earned income to the maximum contribution limit.

Defined Benefit Pension Plan Canada: The Ultimate Guide ... A defined contribution plan (also known as a DC pension plan in Canada), on the other hand, is funded mainly by you as the employee, but your employer can make contributions (e.g. match your contribution to a defined amount).

Defined contribution pension plan - Canada Life A pension plan is a way for you and your employer to set aside money for your retirement. A defined contribution plan is the most common type of pension. Both you and your employer contribute a percent of your salary over the time that you're working, and when you retire you can convert that money into your retirement income.

Defined Contribution Plan Defined Contribution Plan Defined Contribution Plan In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned.

Defined Contribution Pension Plan - RBC Royal Bank Royal Bank of Canada (RBC) is acting in its capacity as a delegate of your employer in connection with its Defined Contribution Pension Plan. MyAdvisor is a platform provided by RBC. Financial planning services and investment advice provided in connection with any RBC investment account opened outside the Defined Contribution Pension Plan is ...

/https://www.thestar.com/content/dam/thestar/business/personal_finance/retirement/2011/09/23/royal_bank_ends_definedbenefit_pensions_for_new_hires/rbc.jpeg)

/https://www.thestar.com/content/dam/thestar/business/2022/01/17/ive-got-a-company-pension-do-i-need-to-be-saving-on-top-of-that-for-retirement/defined_contribution_plans.jpg)

0 Response to "43 defined contribution pension plan canada"

Post a Comment